View Our HVAC Financing Options

We offer several different financing options for new heating and AC systems with competitive rates and can help families with no credit or bad credit.

We also recognize everyone hits hard times that can impact their credit. That’s why we offer Breeze and Microf. These options allow for no credit check. However, it is a pricier financing option. If you have questions or concerns about our credit options or our recommendations, please don’t hesitate to ask.

No Credit Check Heating & Air Conditioning Financing Options

Don’t let a tight budget stop you from getting necessary HVAC improvements. With no credit check financing, you can finance your heating and air conditioning expenses without worrying about your credit score. Learn more about available options and find out how to get started now.

Understand What No Credit Check Financing Entails.

No credit check financing allows individuals with any credit score to have access to financing for their HVAC system. To qualify for no credit check financing, you must be employed and able to provide proof of income. You also must provide a valid government-issued form of identification. Generally, most no-credit check financing options require at least 6 months of continuous payroll deposits in your bank account as proof of income.

Compare Interest Rates and Other Fees/Charges.

When exploring no-credit check financing options, it’s essential to compare the interest rate and other fees or charges associated with the loan. Many companies that offer this type of financing may try to hide additional costs or may have a high-interest rate that differs from traditional loans. Be sure to review all the terms before signing any agreements, and make sure you understand what you’re getting into.

What is Rent-To-Own or Leasing Options?

Bad credit can be a significant obstacle when seeking financial assistance, but there are options available to help individuals overcome this challenge. Rent-to-own programs and leasing arrangements are two avenues that provide opportunities for those with bad credit to access essential resources. These initiatives enable individuals to secure housing or acquire necessary items by spreading out payments over time. Rent-to-own agreements allow individuals to rent a property with the option to buy it at a later date, providing a chance to improve creditworthiness while building equity. Leasing arrangements allow individuals to lease items like vehicles or appliances, providing flexibility and the ability to upgrade to newer models as their circumstances improve. With these options, individuals with bad credit can find the support they need to move forward and improve their financial situation.

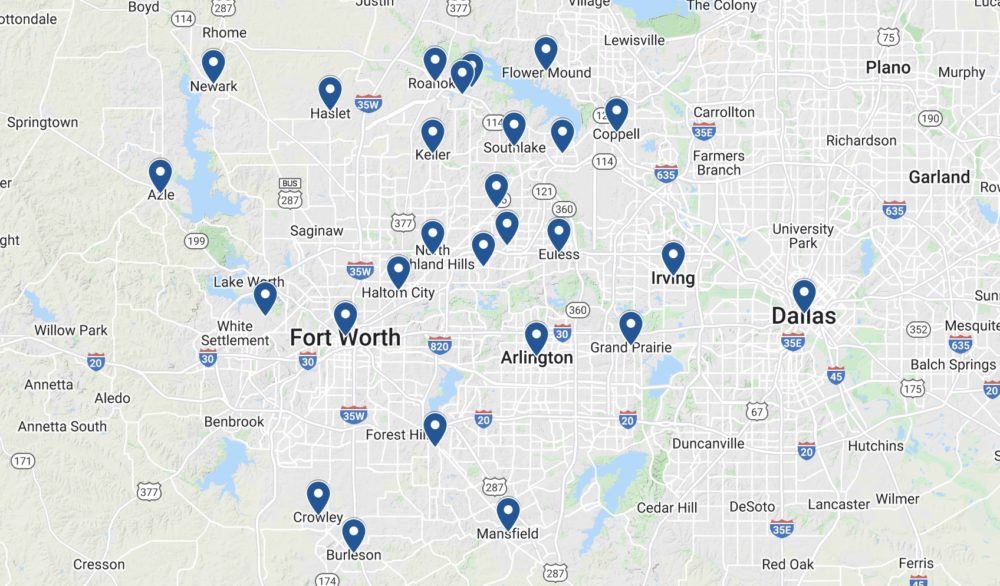

Areas We Serve

Zipcodes in Tarrant county Texas Pride Heating & Air covers.

76244 76262 76014 76001 76002 76003 76004 76005 76006 76007 76008 76009 76010 76011 76012 76013 76014 76015 76016 76017 76018 76019 76020 76021 76022 76034 76036 76039 76040 76051 76052 76053 76054 76060 76063 76092 76094 76095 76096 76099 76101 76102 76103 76104 76105 76106 76107 76108 76109 76110 76111 76112 76113 76114 76115 76116 76117 76118 76119 76120 76121 76123 76124 76126 76127 76131 76132 76133 76134 76135 76136 76137 76140 76140 76147 76148 76155 76161 76162 76163 76164 76177 76178 76179 76180 76181 76182 76185 76244 76248